Disclaimer: The information provided in this guide is for educational purposes only and does not constitute financial, tax, or legal advice. Always consult with a licensed professional before making any financial or investment decisions.

The bitcoin vs real estate debate usually sounds louder than it needs to be. One camp is shouting about digital gold and internet-native money. The other is calmly pointing at land, buildings, and rent checks that show up whether the market’s in a good mood or not. Both sides think they’re right, and honestly, both have a case.

Bitcoin moves fast, trades nonstop, and doesn’t care where you live. Real estate moves more slowly, shows up physically, and has been quietly building wealth long before anyone tweeted about it. That difference is exactly why many investors now look beyond direct ownership and explore real estate investment platforms that combine property fundamentals with modern access. One thrives on volatility and momentum. The other thrives on patience and utility.

The real question isn’t which asset is better. It’s which one matches how you want your money to behave when you’re not watching it?

Bitcoin and property get compared because they both live outside the traditional stock-and-bond playbook. When markets feel shaky, inflation creeps up, or confidence in institutions wobbles, investors start looking for assets that feel more independent and less tied to Wall Street’s mood swings.

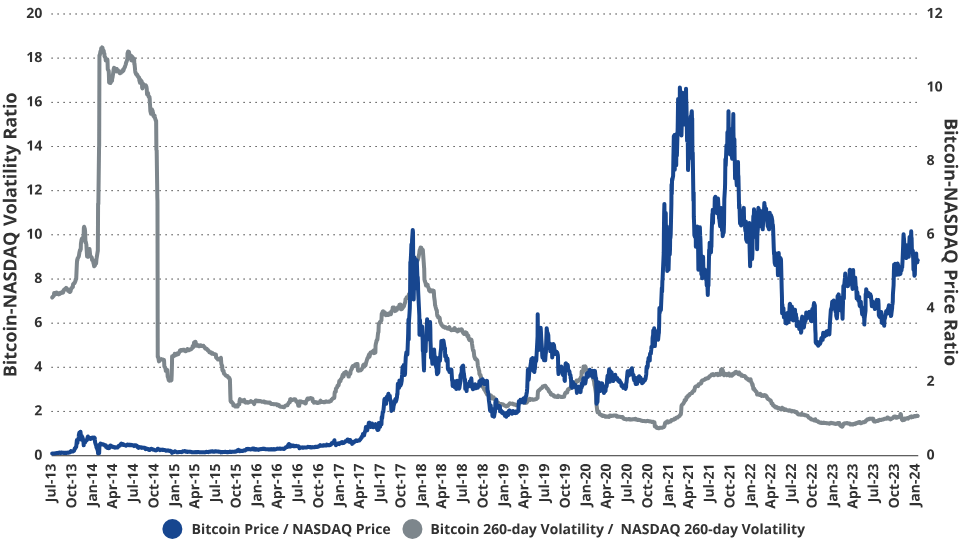

That’s when the bitcoin vs real estate chart makes its entrance. One line looks like a heart monitor after espresso. The other looks like a staircase someone’s been climbing for decades. Same goal, wildly different journeys.

Strip away the hype, and most investors aren’t chasing moonshots or bragging rights. They’re chasing outcomes. The basics rarely change, even if the assets do.

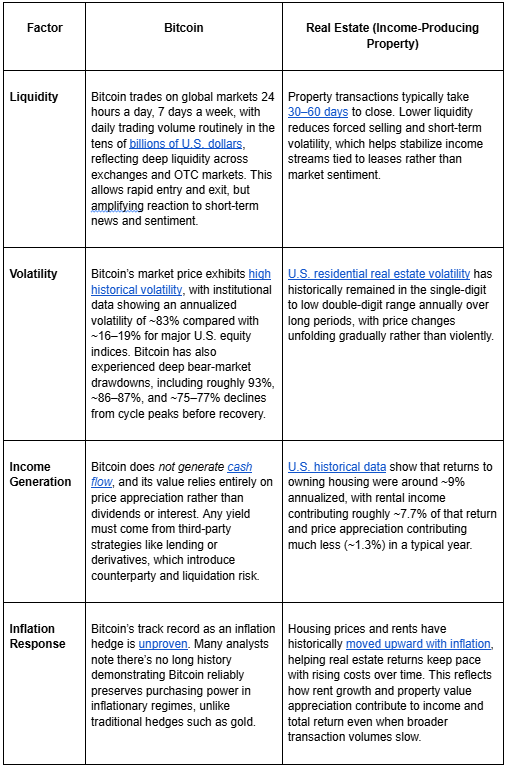

This is where bitcoin and real estate really diverge. Bitcoin emphasizes portability, speed, and upside tied to adoption. Real estate emphasizes income, physical utility, and long-term stability. Neither is magic. They’re just built for different priorities and different personalities.

Bitcoin is a purely digital asset secured by blockchain technology and enforced by math, code, and a global network of computers. There’s no CEO, no central bank, and no office you can call if something goes sideways. Ownership comes down to who controls the private keys.

Bitcoin’s value is driven by supply limits, demand, adoption, and market psychology. There’s no income stream attached. You don’t rent it. You don’t refinance it. You hold it and hope future buyers value it more than you did.

From a practical standpoint, Bitcoin offers:

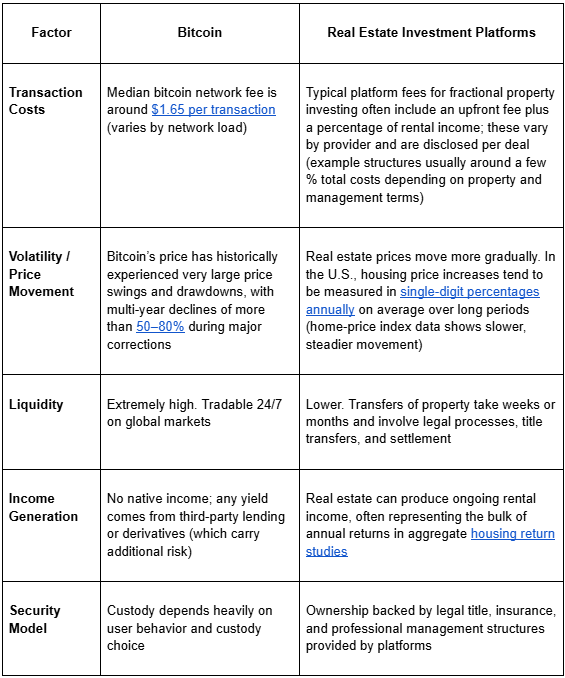

Bitcoin users pay on-chain (network) fees to have transactions confirmed by miners. These fees vary with network demand and congestion, rising when activity is high.

Real estate gives the opposite energy. It’s physical, location-based, and built around utility. People live in it, work in it, and pay to use it. That utility is what gives property its staying power as an asset class.

Traditional real estate investing used to mean buying an entire property, dealing with financing, tenants, maintenance, and paperwork. Fractional investing changed that by letting investors access professionally managed properties without becoming a landlord.

Platforms like mogul focus on access and structure. Properties are professionally vetted, held in individual LLCs, insured, and managed, so investors participate in income and appreciation without handling day-to-day operations.

Real estate typically generates value through:

Fees are transparent and tied to getting the deal right and keeping it running: onboarding, property setup, and ongoing management, with a share connected to rental income. mogul doesn’t profit from constant trading or short-term moves. The incentives are simple: operate the property well, generate income, and let time do the heavy lifting. Liquidity is slower than Bitcoin, and that’s the point. Less whiplash, more consistency, and income that doesn’t care about today’s headlines.

This is where the contrast really sharpens. Bitcoin and real estate don’t just behave differently; they pay you differently, if at all.

Understanding how returns show up matters more than headline numbers.

Bitcoin generates returns one way only: price appreciation. You buy it, you hold it, and at some point, you sell it for more than you paid. That’s the entire playbook.

There’s no native yield. When people talk about bitcoin “income,” they’re usually referring to lending or derivatives, which introduce counterparty risk and additional complexity. Price action remains the primary driver.

Bitcoin’s return profile is shaped by:

This makes bitcoin attractive to investors comfortable with volatility and less dependent on predictable cash flow.

Real estate works more like a business than a trade. Rental income flows in while the underlying asset can appreciate over time. You’re not waiting for a perfect exit to see value.

With fractional real estate platforms, investors can access diversified property exposure without owning a whole home. Deals typically show projected ranges based on underwriting assumptions, not promises, combining rental income and appreciation into a single return profile.

Real estate investing often appeals because:

It’s less flashy than crypto, but it’s built to be durable.

While bitcoin does not produce income on its own, real estate platforms are often used by investors seeking recurring rental distributions without day-to-day property management.

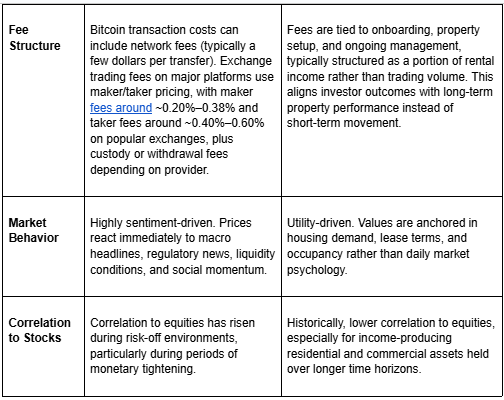

This is where theory meets actual numbers. Fees, friction, and risk matter in the real world, not just in theoretical models.

Inflation and central bank decisions tend to separate the flashy assets from the functional ones. When interest rates rise, liquidity tightens, and cheap money disappears, different asset classes react in very different ways. Bitcoin and real estate are no exception.

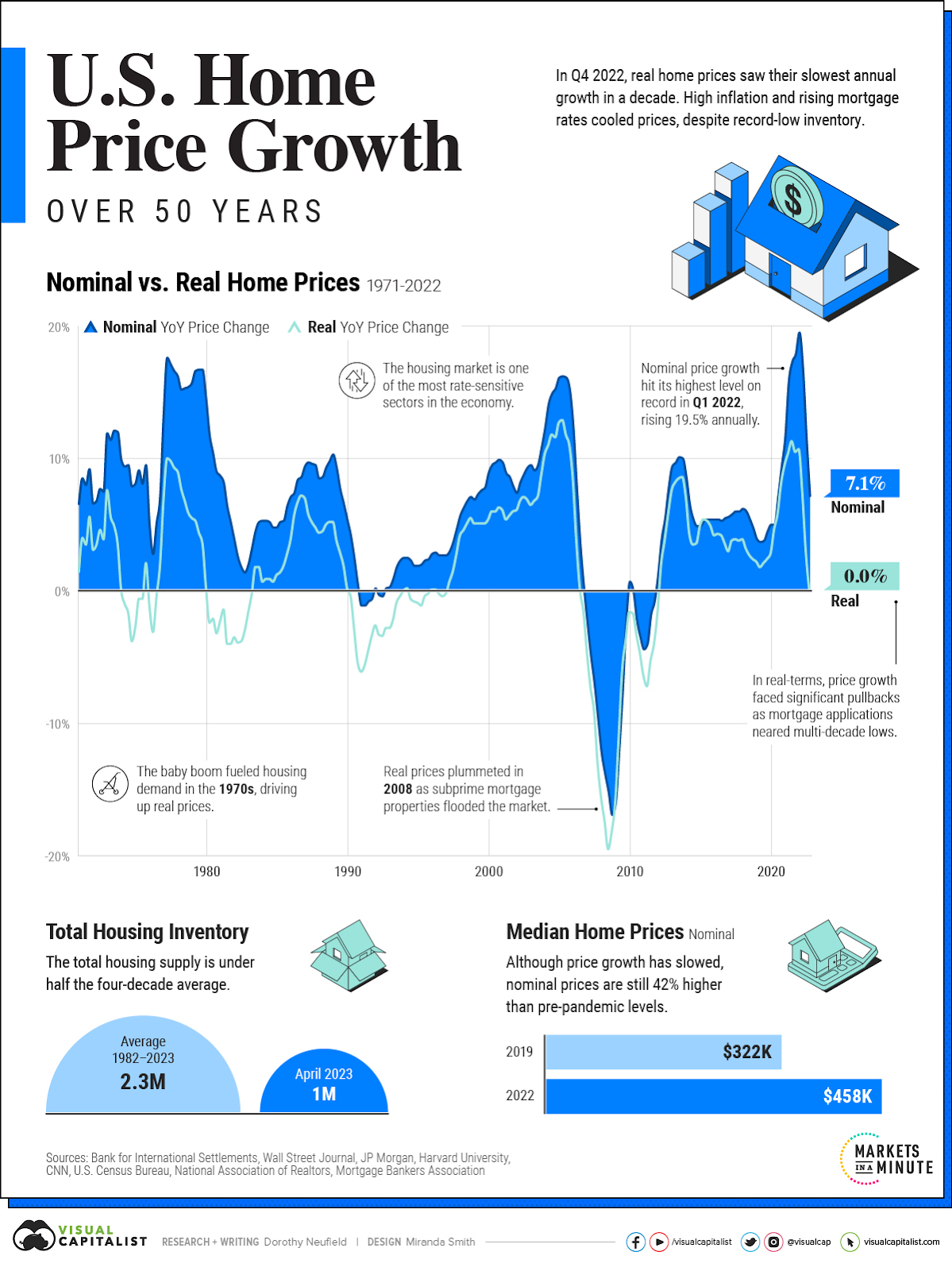

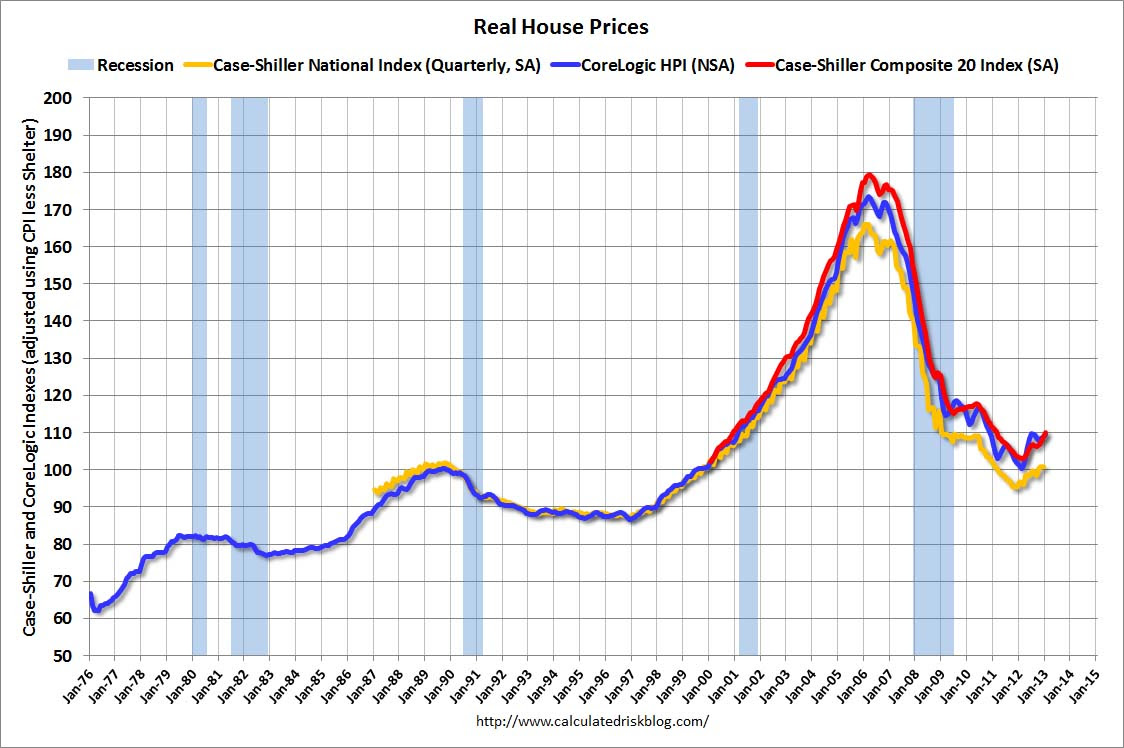

Real estate has historically responded to inflation by adjusting rents and property values over time. While higher rates can slow transaction volume, income-producing property often continues to generate cash flow, even during economic stress. The asset doesn’t vanish just because borrowing costs go up.

Bitcoin’s relationship with inflation is still being written. Some investors treat it as a digital hedge against currency devaluation, while others see it trade more like a high-volatility risk asset during periods of tightening. Monetary policy isn’t about the next quarter. Its effects on real rates and markets can last more than a decade, quietly rewarding assets built on real utility while exposing leverage and speculation when conditions tighten.

Liquidity sounds great until you realize it comes with emotional whiplash. Bitcoin can be bought or sold in seconds, which is powerful, but it also means prices react instantly to fear, hype, politics, or a single headline.

Real estate moves more slowly by design. You can’t panic-sell a building at 2 a.m., and that friction often works in the investor’s favor. Property values tend to adjust gradually, and rental income continues regardless of daily market noise.

This is why many investors don’t frame the decision as either-or. Liquidity is useful. Stability is comforting. The balance between the two often matters more than chasing the best-performing asset in any single year.

The bitcoin vs real estate conversation usually ends with someone declaring a winner. That’s the wrong ending. These assets serve different roles, attract different personalities, and shine under different conditions.

Bitcoin appeals to investors who value speed, portability, and asymmetric upside, and who can tolerate sharp drawdowns without panic. Real estate appeals to investors who want tangible property, recurring income, and a long-term approach to building wealth.

The smartest portfolios don’t chase hype. They focus on access, structure, and how assets behave when markets get uncomfortable. Whether you lean digital, physical, or somewhere in between, clarity beats conviction every time.

The real shift isn’t bitcoin replacing property or property replacing crypto. It’s access getting easier, information getting clearer, and investors demanding platforms that feel professional, secure, and transparent.

Fractional investing with platforms like mogul, better custody solutions, and improved infrastructure across asset classes are changing how people participate. The barrier isn’t capital anymore; it’s understanding how each asset actually works when conditions change. That’s where informed decisions get made, not on social media timelines.

For investors starting with smaller amounts, bitcoin is often accessed through major exchanges or self-custody wallets, offering instant market exposure but significant volatility. Fractional real estate platforms allow investors to spread capital across multiple professionally managed properties with affordable minimums, prioritizing income and structure over speed.

The bitcoin vs real estate debate isn’t about predicting the future. It’s about choosing assets that match your goals, temperament, and timeline. Bitcoin brings liquidity and upside potential, along with serious volatility. Real estate brings income, physical value, and long-term durability built on utility, not momentum.

Neither is perfect. Neither is obsolete. The real win comes from understanding what you own, why you own it, and how it behaves when the market stops being friendly. For investors leaning toward property without the traditional headaches, platforms like mogul offer access to professionally vetted real estate with built-in structure and transparency.

If you’re curious how that looks in practice, you can explore current listings on mogul and see how modern real estate investing is being done today.

Disclaimer: The information provided in this guide is for educational purposes only and does not constitute financial, tax, or legal advice. Always consult with a licensed professional before making any financial or investment decisions.

Over certain periods, particularly the past decade, and in specific 5-year windows. Bitcoin’s headline price returns have significantly exceeded U.S. residential real estate price appreciation. However, those gains have come with much higher volatility and large drawdowns, whereas real estate has delivered steadier, more predictable income and appreciation over longer periods.

The value of a bitcoin investment five years later depends heavily on the entry point and market cycles. Some five-year periods in Bitcoin’s history included deep corrections, with peak-to-trough drawdowns reaching roughly 75–93% before eventual recovery, illustrating that long holding periods spanning major cycles could still contain drawdowns greater than 70%. These swings highlight bitcoin’s speculative nature compared to income-generating assets.

Warren Buffett has consistently criticized bitcoin, calling it an asset with no intrinsic value because it does not produce income or utility. His investment philosophy favors assets that generate cash flow, such as businesses or real estate, which aligns with his long-term, fundamentals-based approach.

Tesla sold a large portion of its bitcoin holdings in 2022 to improve liquidity during operational disruptions. The move underscored how corporate bitcoin exposure can be influenced by short-term financial needs rather than long-term conviction.

Bitcoin generates returns solely through price appreciation and market demand. Real estate generates returns through rental income and property appreciation over time. This structural difference is why real estate is often viewed as an income-producing asset, while bitcoin is viewed as a growth-oriented one.

Inflation often benefits real estate by pushing rents and property values higher over time, while rising interest rates can temporarily slow growth. Bitcoin’s response to inflation and monetary policy has been inconsistent, with periods of strong performance followed by sharp pullbacks during tightening cycles.